If you live in England, Wales or Northern Ireland, you probably think the highest rate of income tax is 45%. While 45% is the highest ‘official’ income tax rate, the way the tax-free personal allowance is treated means that some people actually pay an effective tax rate of 60% on some of their income.

Known as the ‘60% tax trap’, it applies to earnings between £100,000 and £125,140. Here, RBC Brewin Dolphin explains why the tax trap happens and how to manage it.

Income tax and the personal allowance

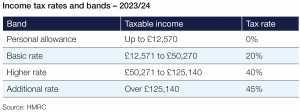

First, it helps to take a step back and understand how income tax is charged. Most people have a personal allowance of £12,570 – that’s the amount of income you do not have to pay tax on each year. If you have a standard personal allowance, the tax rates you’ll pay in each band of earnings are as follows:

Once you earn more than £100,000, however, your tax-free personal allowance starts to be tapered. It reduces by £1 for every £2 that your adjusted net income exceeds £100,000, and is zero if your income is £125,140 or above.

Why the 60% tax trap occurs

The tapering of the personal allowance means someone earning between £100,000 and £125,140 faces an effective 60% tax rate on that portion of their income.

Let’s imagine you earn £110,000 – or £10,000 above the threshold. You would not only pay £4,000 in higher rate tax on the £10,000, but you’d also lose £5,000 of your personal allowance. And with £5,000 of your personal allowance gone, that portion of your income is now also subject to tax at 40%, costing you another £2,000. In other words, of that £10,000, you’d only get to keep £4,000, which equates to a 60% tax rate.

Oliver Rossi / Getty Images

How to reinstate your personal allowance

There is a relatively simple way to mitigate the 60% tax trap – and that’s to save into a pension. If you earn £110,000 and make a gross pension contribution of £10,000, your adjusted net income would fall to £100,000. This would reinstate your full personal allowance and give an effective rate of tax relief of 60% on your pension contribution.

Doing so could also help you in the longer term as you would have boosted your pension pot by £10,000. Thanks to the power of compounded investment returns, this could make a real difference to the value of your pension pot at retirement.

Bear in mind that there is a cap on the amount you and your employer can pay into your pension each year and still get tax relief. For most people, the pension annual allowance is 100% of your UK relevant earnings or £60,000, whichever is lower (this might be tapered if your adjusted income exceeds £260,000). If you exceed your annual allowance, you’ll have to pay an annual allowance charge which essentially claws back any tax relief received on the excess contribution.

Next steps

Understanding how different tax rules might affect you isn’t easy, and that’s where getting some smart advice comes in. At RBC Brewin Dolphin, we can help you keep up to speed, explain how the various rules affect your long-term financial planning, and help you decide on the best course of action for you.

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Information is provided only as an example and is not a recommendation to pursue a particular strategy.

RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444) and regulated in Jersey by the Financial Services Commission. Registered Office; 12 Smithfield Street, London, EC1A 9BD. Registered in England and Wales company number: 2135876. VAT number: GB 690 8994 69